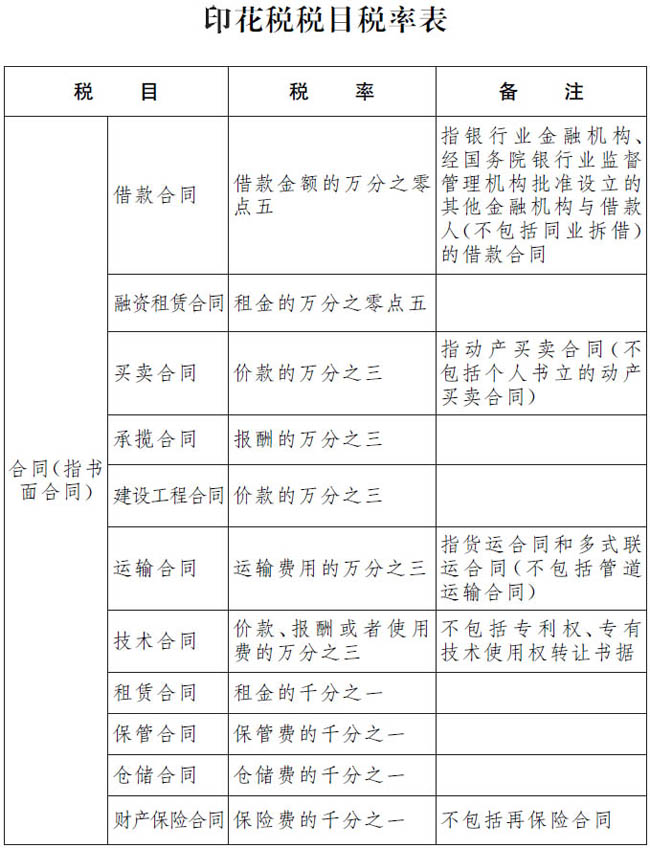

On June 10, 2021, the National People’s Congress (NPC) passed the Stamp Duty Law of the People’s Republic of China (中华人民共和国印花税法) effective July 1, 2022. The Law refers to the taxes collected for various certificates that are registered in transactions in China. The name originates from the use of tax stamps pasted on the corresponding tax vouchers. While usually thought of in respect to securities sales, the stamp tax also applies to intellectual property transactions and patent grants, which will be reduced or eliminated, respectively, by this Law.

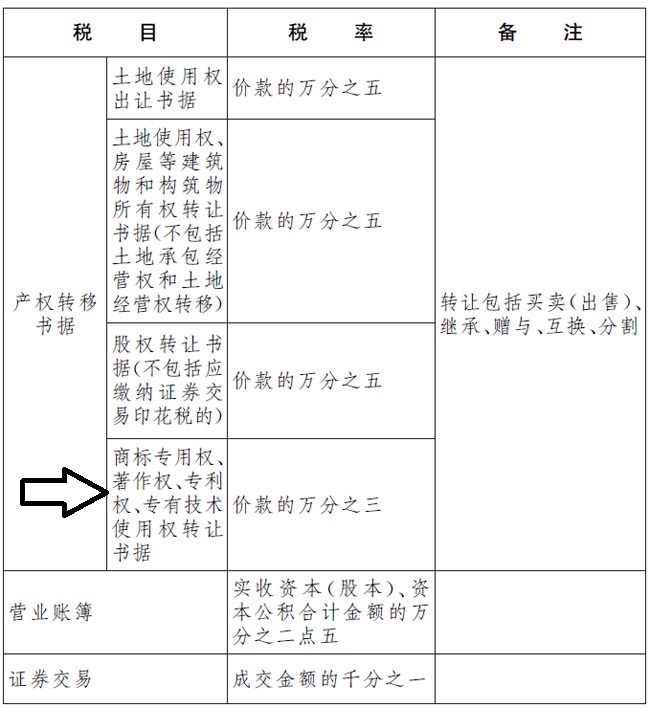

With respect to intellectual property, the main change will be the reduction in stamp tax from from 0.05% to 0.03% on intellectual property transactions, specifically, “documents on the assignment of the exclusive right to use trademark, copyright, patent right or use of know-how” (商标专用权、著作权、专利权、专有技术使用权转让书据).

The tax is determined based on the amount listed in the contract, not including value-added tax (VAT), if any.

In addition, of less importance, the stamp tax for patent grants will be eliminated. However, this is currently only 5 RMB (less than $1 USD).

The full text of the law is available here (Chinese only).

i

i